Discreet Ghostwriting For Entrepreneurs Who Demand Excellence

Ghostwriting Secrets for Entrepreneurs: Turn Ideas into Income (Free Weekly Tips)

Top Reads and Must-Read Articles

Introduction In the high-end watch world, a timepiece is more than just a way to count seconds; it is also a record of skill, history, and lasting value. The priciest...

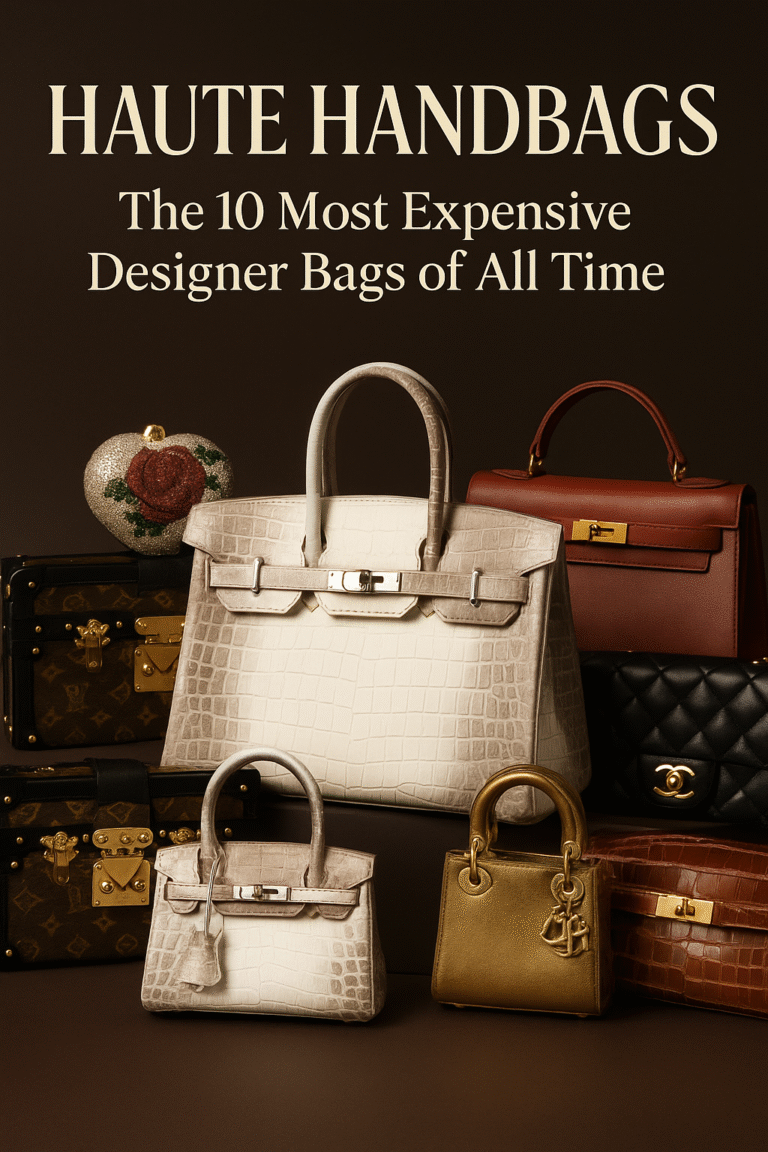

10 Most Expensive Designer Bags of All Time Introduction Luxury handbags have moved way past being just pretty accessories. Today, they sit squarely at the crossroads of...

The Royal Suite Life: Discover the Most Expensive Hotel Rooms in the World Introduction When one night in a hotel costs more than what most of us make in a year, the place...

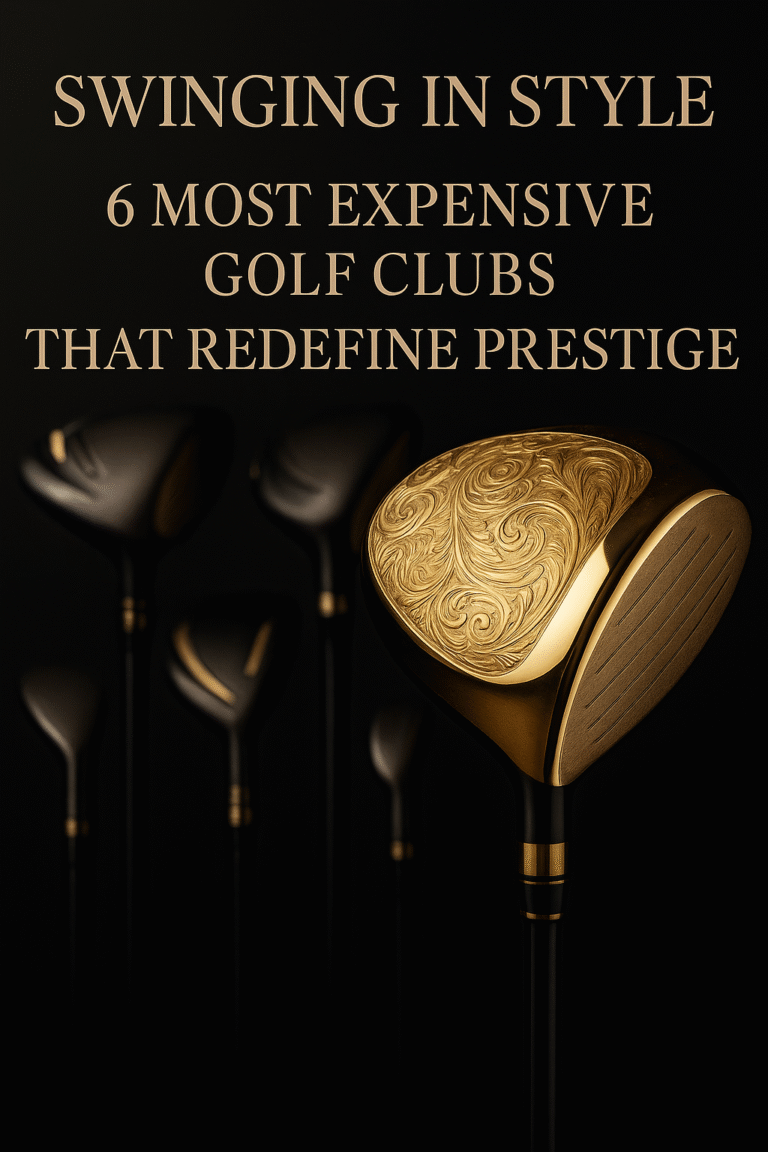

Most Expensive Golf Clubs That Redefine Prestige Golf has always whispered class, but lately, it has started to shout designer luxury. For wealthy players, the game now...

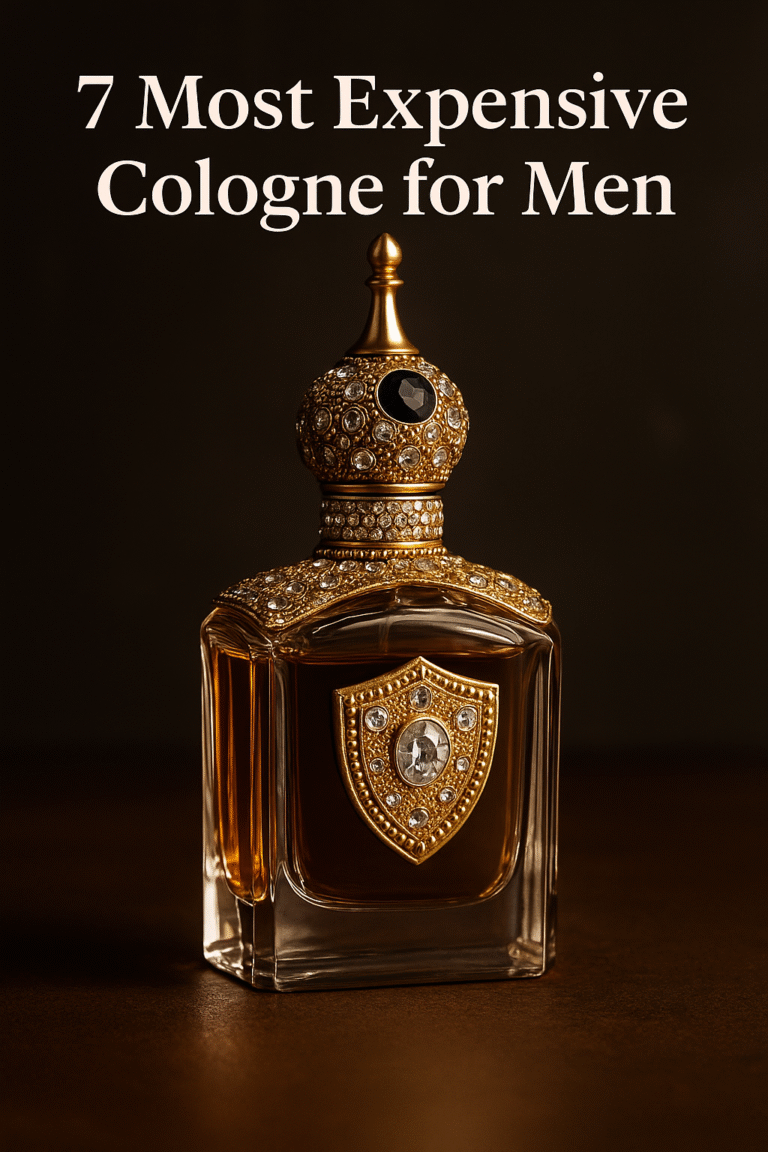

The Most Expensive Cologne for Men in the World Let’s be honest: colognes can run the spectrum from cheap drugstore splash to heirloom-level art. A basic bottle may get...

LE SERENO No need to sugarcoat things. St Barthélemy, or St Barts, a sprawling, super-yacht harbor punctuated with designer boutiques and fuel-stocked grocery shops...

The Patek Philippe Nautilus 5990/1A is one of the most luxurious and advanced timepieces that stands at the peak of Swiss watchmaking. As a contributor to the Nobel...

Luxury and elegance are perfectly combined in the Patek Philippe Aquanaut 5167R. Made by one of the best watchmakers in the world, this watch sums up Patek Philippe’s...

Few timepieces command the reverence afforded to the Patek Philippe Grand Complications 5370P in the rarefied world of haute horlogerie.This exceptional split-second...