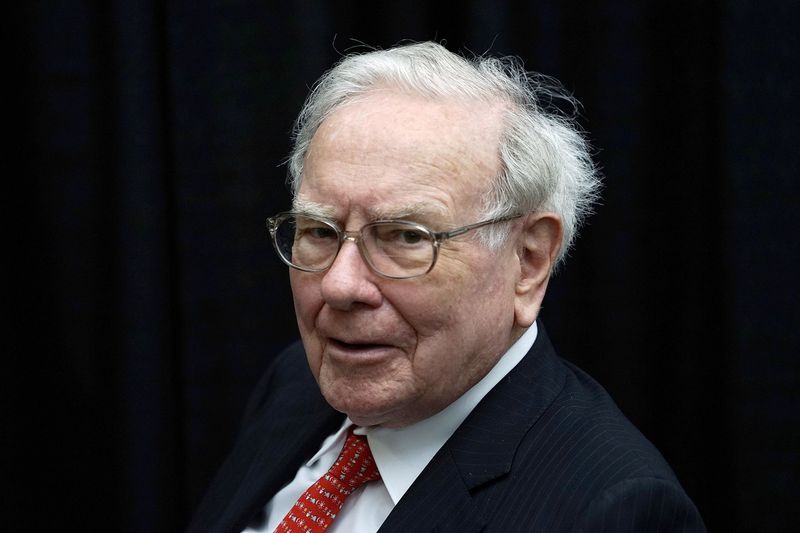

So, you are interested in Warren Buffett’s investment strategies. Perfect, this one’s for you.

This article explains the simple strategy that has managed to appear without fail on the Forbes homepage.

People around the world admire it as much as it works.

We will also consider the basics of value investing, the advantages of properly timing one’s investments, and, most importantly, you should always have business logic when picking your stocks.

By absorbing these insights, you will have a greater sense of discipline and a legacy approach to investing in the markets.

Do you need more certainty about volatile market changes?

Seeking the assistance of professional authors will help you make correct Buffett-like decisions.

Table of Contents

Key Takeaways

Investors must consider the stocks’ past performance and future growth to gauge their potential value.

One’s understanding of a company’s real earnings potential can be enhanced by performing frequent analysis of its financial statements.

By being patient when investing, time can be utilized to maximize the power of compounding.

Investment decisions are more effective according to one’s research than following market sentiment.

Regularly scheduled portfolio assessments ensure the investments comply with the specified strategic criteria.

Understanding the Basics of Value Investing

Many look up to Warren Buffett’s approach when transitioning into value investing.

One key aspect of his success is knowing how to look for undervalued companies that need investment and reading financial disclosures to narrow the search.

In subsequent sections, I will explain and critique some of these underlying my expert writing services practices, which provide valuable perspectives on evaluating a business’s intrinsic value — a basic tenet of Mr. Buffett’s investment technique.

Recognize Undervalued Companies for Investment Having a sharp eye for these investment opportunities requires patience and due diligence.

I’ve learned that the market’s noise can sometimes cause investors to overlook stocks trading below their intrinsic value.

This is reading deep, looking for companies with a strong violation and recession-proof business model weighted for the longer term that would stand and grow the investment target.

Identifying undervalued companies in the market setting stocks with intrinsic value of more than the prevailing market appraisal is like uncovering a refinery in a muddy market.

I target looking into the firms or company stocks whose equity value seems undervalued by the market since their demand and potential are only suppressed by a certain market phase or a widespread wrong view.

My approach to looking into financial strength and future opportunities allows me to search for strong fundamentals such as stable revenue, stable profit resources, and good leverage structures to support investment decisions.

Compare financial statements with the true value.

The first step in analyzing any financial statement as a part of my investment strategy is to start by looking at the balance sheet, income statement, and cash flow statement.

These documents, critical components of any company’s financial life, can also be useful in determining how well or poorly a business operates, generates profits, and manages its cash.

It is also crucial to seek out the actual earning potential of a company as this helps to grasp the depth of the ‘profits’ that are perceived and, therefore, forecasts their chance to be sustained.

To resolve the issue of what a business is worth, focus on these financial ratios: the debt-equity ratio, return on equity, and free cash flow.

These indicators allow me to determine or analyze whether a company is economically healthy or whether its market value needs to be overestimated or overstated.

This structured process is very important for identifying businesses that are worth investing in and have high chances of high returns in the future.

Employ Together Long-term Investment Approaches

Warren Buffett believes primarily in long-term investment styles.

Investors can attain great and lasting success if they stick to the plan of creating wealth through compound returns and avoid the temptation of selling during short-term fluctuations.

Bulleted points discussed later in the paper will assist in understanding the principles of how to grow compound properly for a long time, along with the reasons for being calm and strong through the turbulence of the stock exchange.

Let’s accumulate wealth through Compounding Returns.

As I make a value investing journey, one of the things that has been made clearer to me is the aspect of compounding returns, a principle hallowed everywhere by Warren Buffett.

It is strikingly simple and yet very powerful: use the profits to make more profits!

I endorse this approach because it enables wealth to multiply rapidly, and the impact becomes large in the subsequent years.

I have seen several times now that the true trick to creating wealth is not merely making wise investments but also allowing those investments to be nurtured over time.

Adopting this long-term outlook has allowed me to see firsthand the power of compounding in an investment portfolio and how to stay the course when there are temptations to sell because short-term results indicate otherwise.

Maintain Your Investments Irrespective of Market Changes

Based on my experience sticking to the investment philosophy prescribed by Warren Buffett, patience is the most crucial element during times of turbulence in the market.

While equities may sometimes sway, I think back to Buffett’s saying that money is transferred from the impatient to the patient in the stock market.

This mindset allows me to keep my investments alive, focusing on them for future returns despite suffering some losses in the short run due to volatility.

Thanks to the volatility, I have found it useful to observe how the market operates without selling all my positions; stock prices during turbulence can be insignificant when projected against long-term focus.

I discovered that weathering these turbulent times strengthens one’s resolve and tempers one’s sense of devotion, which is required to gain the perspective to see a long-term investment grow through time.

Leverage on Business Dynamics in Picking Stocks

While trying to understand Warren Buffett’s investment philosophy, I emphasize the importance of management and governance appraisal alongside the evaluation of competitive advantages and economic moats.

These aspects are fundamental in the selection of stocks that are destined to succeed in the long run.

I seek to understand the individuals in charge and, second, the strength of the company’s competitive position, which assists in making stock selections that will result in growth over time.

Assess Management and Governance

In assessing the quality of management and governance within a firm, I consider past leadership performance and the present and future obstacles they must overcome.

The senior managers in the executive suite have, more often than not, always been there to show the best path to success for the company.

That experiential knowledge will chin influence the general strategy and performance of the company.

I seek to evaluate their clarity of vision, make effective decisions, and conduct financially reasonable actions to see if those individuals can lead the organization effectively for long-term performance.

In addition, the strength of corporate governance practices is also important for me when assessing stocks.

Effective governance means that a corporation is operated with the better interests of its shareholders in mind.

Thus, there are safeguards to inhibit abuse and promote accountability.

I assess the ownership structure of the board, the policies and practices regarding stakeholder engagement, and the ethics as primary proxies regarding the firm’s ethos in maintaining its governance and management quality.

Analyze Competitive Edge and Economic Moat

As I try to emulate Warren Buffett in the areas of investment, it is important to consider the companies’ competitive edges and economic moats first.

A firm with a wide economic moat has certain characteristics that bring in business and make it profitable, including patents, a strong brand name, or licenses from the regulators.

I make it a point to first invest in companies with a clear economic moat.

They are better at sustaining their market share and returning value to their shareholders.

My experience shows that firms with a strong competitive edge can fare well through an economic slump and will emerge from it even more robust.

More often than not, such companies have a loyal clientele, price, and scale of efficiency in the industry.

For instance, in my evaluation, such characteristics are a strong sign of a business surviving for the long haul.

It’s a message that the company may provide considerable payoffs to investors with a tolerance for time.

Understanding Why Warren Buffet Always Stresses Patience as the Best Tool for Investing

One must emphasize patience if one wishes to replicate Warren Buffett’s investment strategy.

The most regretful investment decisions I made came at a time when the market was experiencing high volatility… however,

I learned the hard way I did, and with hard lessons comes an unwavering patience to make sound market decisions.

Moving forward, I will discuss how being patient and timing the right moment to invest can change everything for you in finance.

Such principles have been beneficial in helping value investment strategies where the belief is to seek great returns in a timeframe more than in an instant.

Be Cautious of Sudden Decisions in Uncertain Markets

The turbulent ambiance of the market has pushed me to recognize that one of Buffet’s investment rules is to try and avoid being impulsive.

Volatility can lead one to pull some or all of the funds, thus defeating the entire purpose of diversification.

My evaluation of the shifts in the market and overall indicators is quite long.

It is rooted in the long-term strategy instead of the brief and low-volume market buzz.

My efforts in exercising Buffet’s philosophy show that being quick often doesn’t work.

It is wiser to take one’s time and analyze the volatility in the market as opposed to panicking and selling everything during such downturns.

I have learned to wait, composed, around the trading desk until I know exactly what I want from an investment and understand its fundamentals.

As addressed now, such disciplined patience is key in capturing lucrative return potential.

Invest Wisely and Look for the Perfect Period to Invest.

Warren Buffet once claimed that time in the market beats the timing of the market, and ever since, I have experienced so many people racing to throw their hands around an investment to ensure they do not miss out.

For me, patience has always been instead a more disciplined way of practicing my “what would Warren Buffett do” techniques.

That way, I let emotion sit in the back seat, not letting greed or worry dictate future investments.

In several cases, I have witnessed the market sentiment drive prices down for fundamentally strong companies so much that it offers a great investment opportunity.

As I have suggested on numerous occasions, instead of riding the wave of the market, I focus on securing good businesses at a discount and wait for such periods where, in the future, I could sell that particular business for a considerably higher price.

Avoid Market Noise and Movement in Investing

It is worth remembering Warren Buffett’s key tagline – ‘focus on the fundamentals’.

Hence, in such scenarios, I try to avoid the maelstrom of short-term noise and survive on my research.

In the next segments, I will explain why one has to intentionally choose to ignore the dominant theme of volatile markets to base one’s future investments on the more stable and predictive indicators.

With such an approach, the investors would focus on substantial and long-term traction that a business may be able to generate and not the transient adulation it may receive. This is critical for long-term success in investing.

Suppress the Market Chatter

Again, short-term market noise is detrimental in the investment world, and Warren Buffett’s strategies have reiterated this fact to me in a much clearer fashion.

Concentrating on the bigger picture enables me to appreciate better the news in terms of whether it would have any significant long-term impact on the company’s true value.

Such selective focus assists in maintaining an investment philosophy focusing on fundamental value and not on arbitrary changes in the marketplace, establishing a stronger basis for reasoned investment choices.

I have proven this to be true, and most people understand this.

Still, the reality is that market movements impact more investors than they would admit.

I have proven this to be true, and so have others, but the truth is that more people are moved by the ups and downs of the market than they would like to admit.

Through this belief, I find companies with sound characteristics and great potential.

This allows me to keep a cool head because a smart mind can always extract sand dollars.

So, this process enables my investments to be driven rationally and not by market sentiments and news cycles.

Trust in Yourself, and Don’t Follow the Crowd

Regarding investment, independent research, as opposed to the noise resulting from the popular view, is highly critical. Instead of getting carried away with market euphoria or the latest financial expert’s fads, I thoroughly scrutinize company filings, business cycles, and available macroeconomic statistics.

With ample supporting evidence, I can justify my investments based on credible statistics echoing a reasonably good level of stochastic modeling in line with Warren Buffett’s off-the-record quest approach towards investing.

Following my angled vision fueled by a deep-dive analysis, I can also chase investment prospects likely to be missed by people who readily succumb to varying popular views.

By looking into the matters myself, such as the state of the balance sheet as well as the dynamics of the competitive posture,

I do focus on the values of the business and make a purchase considering Buffet’s rule that “it’s much easier to buy a great company at a modest price than it is to buy a mediocre company at a great price.”

Sustaining Discipline and Regularity in Investments

Warren Buffett’s investment method requires a lot of discipline and regularity, which is the most important trait of any investor in supporting investment decisions.

With time and practice, being fiercely protective of your investment strategy ensures that sound investments are made rather than following the hot themes of the moment.

Regular review and changes to your portfolio are necessary since a certain level of variability is required concerning economic conditions.

Such talks will soon follow, where we will discuss these golden principles, which are crucial in yielding extensive long-term benefits from investments.

Follow Your Investing Guidelines Without Exceptions

Investment by a strict list of guidelines always appeared to be paramount.

Rather than putting a portfolio together to execute particular investment objectives, I have the support and discipline to please my long-term investment vision.

This work was not easy; it required dedication to both qualitative and quantitative determinants that, in my opinion, are essential, such as trust in leadership, economics, and various market doomsdays; it is a plan that protects one from getting swayed by the cruel winds of “What’s Hot” marketing.

Furthermore, the consistent criteria I apply to my investment decisions have helped me eliminate the noise from the temporary buzz.

Thus, this discipline allowed me to execute investments with high confidence that pass my criteria and are likely to be successful.

This rather practical thing aids individuals in avoiding rash decision-making that could hamper the compounding effect expected from the growth of wealth over the long term.

Keep Checking and Altering Your Portfolio

As a follower of Warren Buffett’s teachings, I have made it a practice to occasionally re-examine and re-balance my investment portfolio using the calendar.

It is important because the economic climate and a company’s future may change and require a revision to ascertain that my requirements for holding each investment have stayed the same.

I do these reviews on a three-month basis, during which I analyze the performance history, the recent activities of the company in question, and its compliance with my specific investment objective.

If, during such regular inspections of my portfolio, a difference occurs between its actual state and my investment strategy, I am usually compelled to act.

This could involve and not be limited to relocating some assets, liquidating certain positions that no longer serve my interest, or acquiring stocks that appeal to my value investment strategies.

Through this systematic approach, I passively manage my portfolio in line with the Buffett System, which involves a systematic and patient investment approach.